There are two types of costs or expenses in an escrow: recurring costs and non-recurring costs.

RECURRING COSTS

Costs which the party pays at closing but will continue to occur or be repeated after the escrow closes as a cost of maintaining the property such as:

- Interest on the New Loan

- Real Property Taxes

- Homeowners’s Association Dues

- Fire Insurance Premium

NON-RECURRING COSTS

Costs which are charged ONE TIME ONLY as an expense of closing the transaction. Such as:

- Escrow Fees

- Notary Fees

- Messenger Fees

- Title Company Expense such as Title Insurance Premium, Endorsements to titles Polices, Sub-Escrow Fee which may be due to Title Company, Re-conveyance Fees, Documentary Transfer Tax.

- Transfer or Document Fees to a Homeowner’s Association

- In the case of a sale, Expenses such as Real Estate Broker Commissions, Fees For Property Disclosures or City Reports, Transaction Coordinator Fee, Home Warranty Premium.

- Lender’s Cost such as, Appraisal, Credit Report, Loan Origination, Loan Processing, Documents Fees, Tax Service Contract.

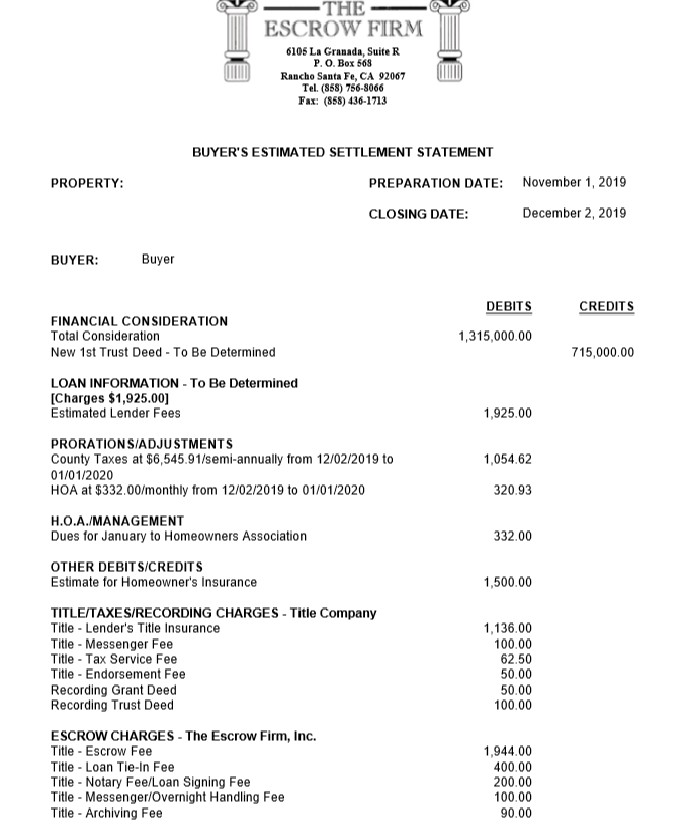

Here is a sample of closing costs estimate for a Buyer who purchased a house for $1,315,000 with $715,000 mortgage. Total closing costs is about $10,000

Shirin Rezania Ramos | 858-345-0685 | www.DelMarValley.com | Lic. 02033796 | Compass