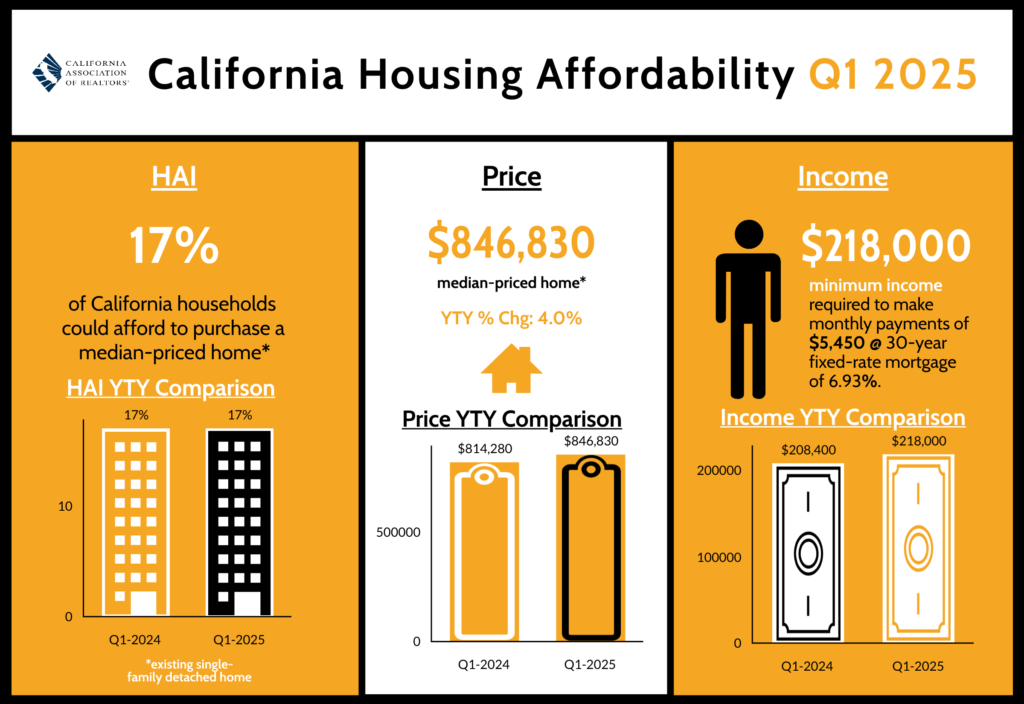

In the first quarter of 2025, the California Housing Affordability Index (HAI) showed that 17% of households in the state could afford to buy a median-priced existing single-family home. This percentage has remained the same compared to the first quarter of 2024.

Home Prices

The median price of a home in California has increased by 4% compared to the previous year. In Q1 2024, the median price was $814,280, and by Q1 2025, it rose to $846,830.

Income Requirements

To afford a median-priced home in California, a household would need a minimum annual income of $218,000. This income is necessary to manage monthly mortgage payments of about $5,450, assuming a 30-year fixed-rate mortgage at an interest rate of 6.93%. This required income has increased from $208,400 in Q1 2024 to $218,000 in Q1 2025.

Possible Effects for Home Buyers and Sellers

• Buyers:

– Higher home prices and income requirements may make it harder for some buyers to qualify for a mortgage. It is important to partner with your real estate agent to guide you and make informed decision when buying.

– Only 17% of households can afford a median-priced home, limiting options for many buyers.

• Sellers:

– Sellers may benefit from increased home prices, potentially yielding you to higher profits.

– With affordability challenges, there may be fewer qualified buyers in the market, potentially affecting the speed of sales. It will help you choose the right buyer if you seek help and guidance with your agent

In summary, while the affordability index has remained stable, both home prices and the necessary income to afford these homes have risen over the past year. Understanding these trends can help potential homebuyers prepare financially for purchasing a home in California.

Source: California Association of Realtors

What is your home worth? click here.

Homes for sale in Carmel Valley click here.

Shirin Rezania Ramos | 858.345.0685 | www.shirinramos.com | Compass, DRE 0203379